Water damage can be a homeowner’s worst nightmare, often resulting in expensive repairs, significant stress, and potential issues with their insurance policy. It is essential to understand how homeowners insurance, including optional coverages like flood insurance and mold coverage, interacts with such damage to protect your investment. This article delves into the various types of water damage that homeowners insurance typically covers, such as burst pipes and roof leaks, while highlighting what is often excluded, like gradual damage and sewage backups. Furthermore, we will provide prevention tips, outline steps to take if damage occurs, explain how to file a claim effectively and discuss the importance of understanding insurance exclusions and deductible payments. Continue reading to navigate the complexities of water damage coverage with confidence.

Does Homeowners Insurance Cover Water Damage in Omaha?

When considering homeowners insurance, one of the most significant concerns for property owners is whether their policy includes coverage for water damage. Homeowners need to understand the various types of coverage available to protect their property and personal belongings from potential financial losses caused by sudden and accidental water damage. Typically, policies will cover certain types of water damage while excluding others, and navigating these specifics can be pretty overwhelming, especially when faced with unexpected repair costs or when working with an insurance adjuster. This guide aims to clarify what homeowners should know about their homeowner’s insurance and water damage coverage.

Homeowners must familiarize themselves with the specific coverage limits and insurance terms outlined in their policies, which can vary significantly. For example, some policies may offer extensive coverage for water damage from ruptured pipes or appliance failures, while others may exclude damages due to flooding or lack of maintenance.

It is crucial to review the policy exclusions, endorsements, and the role of the insurance carrier that may affect coverage, particularly during adverse weather conditions or unforeseen incidents.

In case of a water damage incident, the claims process, including working with an insurance adjuster and understanding the insurance limits, can seem daunting. It usually begins with filing a claim, which undergoes a thorough insurance investigation and claims support process. The role of the insurance adjuster is vital during this stage; they assess the damage, determine its cause, and clarify the homeowners’ responsibilities and insurance information throughout the process.

To navigate this landscape effectively, homeowners should:

- Maintain proper documentation of any water damage and repairs.

- Regularly review their insurance policy to stay informed about any changes in coverage.

- Communicate clearly and promptly with their insurance adjuster throughout the claims process.

By being proactive and well-informed, homeowners can successfully navigate the complexities of their insurance policies.

What Types of Water Damage Are Covered by Homeowners Insurance?

Homeowners insurance usually covers a range of water damage, provided it is sudden and accidental, and outlines specific coverage types. This coverage protects homeowners from unexpected financial burdens, including high repair costs and personal property loss.

It’s essential to understand what a standard homeowners policy includes, such as special personal property coverage and water backup coverage, as this knowledge plays a crucial role in planning and managing finances when faced with potential water-related incidents, such as burst pipes or leaking appliances.

Additionally, different policies may offer optional coverages like basement flooding and winterizing your home, which can prevent water damage from events such as heavy rainstorms. Being aware of what is included in your policy can assist in preventing water damage and reducing repair costs before a disaster occurs, supported by proactive measures like hiring a mitigation expert.

Burst Pipes

Burst pipes are a frequent source of water damage that homeowners insurance generally covers, as they are considered sudden and accidental events, typically addressed within the claims process facilitated by your insurance carrier. When a pipe bursts due to freezing temperatures or high water pressure, the resulting water damage can lead to substantial repair costs if not addressed promptly, potentially impacting personal belongings and the need for a quick response. Homeowners must understand that a fast response and regular maintenance can help minimize damage. Additionally, having the right insurance and being informed about coverage types can provide peace of mind during these unpredictable situations.

Understanding how these incidents occur is essential for managing homeowner responsibilities and ensuring appropriate deductible payments. Often, burst pipes result from prolonged exposure to low temperatures or the natural wear and tear of aging plumbing systems, which are sometimes not covered under a home warranty. Homeowners are encouraged to review their insurance policies to ensure coverage for such water damage. While typical homeowner insurance does offer protection against burst pipes, the specifics can differ, making it advisable to discuss these details with an insurance agent.

In case of a burst pipe, immediate actions such as shutting off the water supply, contacting a professional plumber, and notifying your insurance carrier are crucial. Implementing preventative measures, like insulating pipes and maintaining consistent indoor temperatures, can significantly diminish the chances of such failures. Regular plumbing inspections and maintenance further reduce risks and contribute to a more resilient home environment.

To navigate the aftermath effectively, homeowners should also consider the following steps:

- Document any damage with photographs.

- Contact your insurance company promptly.

- Keep records of all repair work completed.

By following these steps and understanding their coverage options, homeowners can better manage the challenges that arise from burst pipes and be prepared for any unforeseen issues.

Leaking Appliances

Leaking appliances, such as water heaters, dishwashers, and washing machines, can often lead to water damage, which homeowners insurance typically covers under specific conditions, with support from claims experts to identify the cause of damage. If the leak occurs suddenly and accidentally, most insurance policies will cover the damage to personal property and the home itself, which can significantly reduce repair costs.

Homeowners need to regularly maintain their appliances to prevent leaks and minimize the likelihood of a costly claim.

Common scenarios contributing to leaks include worn-out hoses, faulty seals, and overlooked maintenance schedules, which may require attention from a mitigation expert to prevent further water seepage. Many homeowners may not realize that even minor issues, such as a simple hose deterioration, can escalate into significant water damage if left unchecked.

Regular inspections can help identify potential problems before they become burdensome, supporting the homeowner in understanding legal definitions and coverage limits. Proactive maintenance not only preserves the integrity of appliance systems but also streamlines the claims process should a leak occur, such as from a water heater or sump pump issue.

To assist in this effort, homeowners might consider the following practices:

- Documenting the state of appliances regularly.

- Maintaining a schedule for cleaning and inspections.

- Having a professional assess older units.

It is also crucial to understand the fine print of insurance policies, as specific exclusions may limit coverage, such as neglecting proper maintenance or failing to address minor leaks promptly.

Ultimately, being proactive about appliance upkeep can save homeowners in repair costs and help ensure that their property remains protected against unexpected water damage, with financial advice from insurance professionals and coverage from rental insurance if applicable.

Roof Leaks

Roof leaks can lead to substantial water damage in a home, and homeowners insurance typically covers such incidents as long as they do not result from neglect or lack of maintenance.

For many homeowners, the first indication of a problem may manifest as unsightly stains on ceilings or walls, signaling that immediate attention and communication with an insurance carrier are required. Identifying common causes of roof leaks—such as aged shingles, clogged gutters, or improper flashing—is crucial for maintaining the home’s integrity and ensuring proper coverage. Additionally, regular inspections and proactive maintenance can help mitigate these risks.

It is also essential to recognize that while homeowners insurance can provide some protection, policies often include specific provisions, such as exclusions for damage caused by neglect and deductibles that may necessitate out-of-pocket expenses before coverage applies.

Therefore, familiarizing oneself with the specific terms of a homeowners policy can be highly beneficial. By implementing preventative strategies like routine inspections and enlisting professional help when necessary, homeowners can ensure that potential issues are detected early, significantly reducing the risk of incurring costly water damage in the future.

Plumbing Issues

Plumbing issues, such as leaks and malfunctions, can lead to significant water damage, generally covered by homeowners insurance, provided these issues arise from sudden and accidental causes. Homeowners should take a proactive approach when addressing plumbing problems; delaying action can result in more significant claims and increased repair costs. Understanding how to navigate the insurance claims process and what to expect from insurance carriers, such as Progressive Home and the National Flood Insurance Program, will give homeowners the power to manage potential water damages effectively.

Awareness of common plumbing problems can substantially aid in preventing damage and ensuring a smooth recovery process.

- Leaky Pipes: Slow leaks often go unnoticed until they cause significant damage.

- Clogged Drains: These can lead to overflow situations that might not be covered unless explicitly stated in the policy.

- Malfunctioning Appliances: Dishwashers and washing machines can cause flooding if they fail.

It is important to note that coverage can vary significantly based on the cause of the plumbing failure; for instance, wear and tear or neglect typically falls outside homeowners’ coverage. Understanding the policy type is crucial to know what is included.

Understanding the claim process requires proper documentation of the damage and contacting the insurance company beforehand to provide details and evidence as needed. Collaborating closely with an insurance adjuster can help clarify what is covered under the policy and streamline the response efforts.

Taking preventative measures, such as regular maintenance checks and prompt repairs, is essential for minimizing risks and keeping one’s home safe from plumbing disasters.

Flood Damage

Flood damage presents a complex challenge for homeowners regarding insurance, as many standard policies do not cover flooding unless specific flood insurance is purchased. Homeowners need to understand the distinctions between general water damage and flood damage and how the National Flood Insurance Program (NFIP) can provide additional coverage for those living in flood-prone areas.

Correct insurance information is critical to protect against potential financial losses resulting from flooding.

Understanding the differences between flood damage and other water-related issues is vital for homeowners, as this knowledge can significantly impact their financial security. For example, water damage caused by burst pipes or appliance leaks is typically covered under standard homeowners insurance, whereas flood damage requires a separate policy. This distinction is crucial for individuals residing in high-risk flood zones, where standard coverage may expose them to significant risks.

- Obtain Flood Insurance: This is not merely a suggestion but essential for safeguarding your assets.

- Claims Process: Policyholders should promptly report the damage to their insurance provider to initiate the claims process after a flood.

In conclusion, being aware and prepared can make a significant difference when navigating the recovery process related to flood damage.

What Types of Water Damage Are Not Covered by Homeowners Insurance?

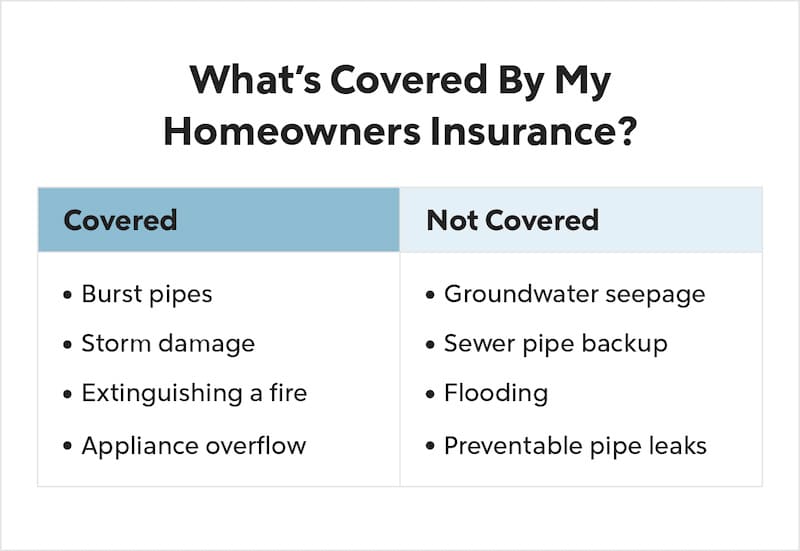

Homeowners’ insurance does cover various types of water damage, but homeowners must be aware of significant exclusions to avoid surprises when filing claims.

Standard exclusions generally encompass gradual water damage, which develops over time and is typically associated with maintenance issues and damage resulting from sewage backups or groundwater seepage.

By understanding these insurance exclusions, homeowners can take proactive steps to prevent potential damage and ensure they are well-prepared for any issues.

Gradual Water Damage

Gradual water damage is often excluded from homeowners insurance policies because it generally stems from a lack of maintenance rather than an unforeseen event. Over time, issues such as water leaks or seepage can inflict substantial damage, but since these problems develop gradually, they are frequently not covered by standard homeowners policies. Homeowners must proactively address maintenance concerns to prevent this type of damage and the accompanying repair costs.

Many homeowners may not recognize that even a minor water leak from appliances, aging pipes, or excessive humidity can contribute to this slow yet destructive issue. Consider scenarios like:

- Hidden leaks behind walls that gradually saturate structures.

- Condensation on windows and pipes that encourages mold growth.

- Blocked gutters that allow rainwater to pool around the house.

Regular inspections and timely repairs can significantly help mitigate these issues, underscoring the importance of being vigilant about maintenance problems. Overlooking these problems can lead to considerable financial strain, as repairs or mold remediation costs can escalate rapidly if left untreated.

Therefore, staying ahead of maintenance protects the property and helps preserve its value.

Sewage Backup

Sewage backup can lead to significant water damage, yet it is often not included in standard homeowners insurance policies. Therefore, homeowners need to clearly understand their coverage limits, including any optional sewer coverage.

Grasping the implications of sewage backup is crucial, as the financial impact can be severe. Many insurance providers, including Progressive Home, exclude these incidents from standard coverage. A homeowner may be liable for substantial cleanup and repair costs if they have proactively added specific endorsements or riders to their policy. Being aware of these standard exclusions can certainly shape their decisions regarding insurance.

Homeowners should also consider exploring optional coverages that fill this gap, such as:

- Sewage backup endorsements

- Finished basement coverage

- Additional living expenses coverage for temporary housing needs

Furthermore, implementing mitigation strategies—such as regular plumbing maintenance checks and installing backflow valves—can help prevent these costly situations from arising in the first place. By remaining informed and prepared, homeowners can shield themselves from a sewage backup’s potentially overwhelming financial consequences.

Groundwater Seepage

Groundwater seepage is a common type of water damage that homeowners insurance often excludes, presenting a significant challenge for many property owners. This issue arises when water from the ground infiltrates basements or foundations, leading to expensive repairs that most insurance policies do not cover. Homeowners must understand these insurance terms to effectively manage their risks and consider additional options to protect their properties, such as purchasing separate flood insurance through the National Flood Insurance Program.

Understanding how groundwater seepage manifests is crucial for homeowners. This phenomenon typically occurs due to heavy rainfall, melting snow, or rising water tables, which allow moisture to enter structures. When the soil becomes saturated, it exerts pressure against walls and foundations, resulting in cracks and leaks. Unfortunately, many insurance policies exclude coverage for this problem, exposing homeowners financially.

To protect against such damage, property owners can take several preventative measures, aligning with homeowners’ responsibilities. Here are some actionable steps to consider:

- Install proper drainage systems to redirect water away from the foundation.

- Regularly inspect gutters and downspouts for blockages.

- Maintain landscaping to promote water flow away from the home.

Homeowners should prioritize a thorough understanding of their insurance policies, as the terms can vary significantly. Being proactive can help alleviate potential headaches and financial strain related to groundwater seepage, ensuring one’s home remains a haven.

Neglect or Lack of Maintenance

Neglect or a lack of maintenance can significantly contribute to water damage exclusions in homeowners insurance policies. Insurance providers often stipulate that if damage arises from inadequate upkeep or the failure to address known issues, they may deny claims, leaving homeowners to shoulder the repair costs themselves.

For many homeowners, grasping the potential consequences of neglect is crucial to protecting their investment. Regular maintenance goes beyond mere cosmetic appeal; it is essential for the overall integrity of a home.

Everyday maintenance issues, such as:

- Leaky roofs

- Clogged gutters

- Damaged window seals

- Faulty plumbing

can lead to considerable water damage if not addressed promptly. Insurers are likely to consider these factors when assessing coverage. Therefore, conducting regular home inspections can help identify potential problems early on.

Homeowners can significantly reduce their risks by taking preventative measures—like clearing debris from gutters and inspecting plumbing systems. Staying proactive with maintenance contributes to the home’s upkeep and helps preserve the insurance coverage that is vital for protecting against unforeseen financial burdens.

How Can Homeowners Prevent Water Damage?

Preventing water damage is crucial for homeowners who want to protect their property and maintain their homeowner’s insurance coverage. Homeowners can significantly reduce the risk of unexpected water damage by taking proactive steps, such as performing regular maintenance, winterizing their homes, and promptly addressing any plumbing issues.

Understanding how these preventative measures can safeguard the home’s structure and personal belongings is essential. Ultimately, this leads to fewer insurance claims and reduced repair costs.

What Should Homeowners Do If They Experience Water Damage?

When homeowners encounter water damage, it is essential to act quickly to mitigate the situation and safeguard their property and insurance coverage.

The initial steps should include:

- Stopping the source of the water

- Documenting the extent of the damage

- Reaching out to their insurance carrier as soon as possible

Involving an insurance adjuster and, if necessary, a mitigation expert can assist in navigating the claims process and securing the best possible outcome for repairs and coverage.

What Are the Steps to Filing a Water Damage Claim with Homeowners Insurance?

Filing a water damage claim with homeowners insurance is a structured process that homeowners should follow to increase their chances of approval and reimbursement. It begins with documenting the damage and reaching out to their insurance carrier.

Homeowners must provide detailed information to the insurance adjuster, who will assess the situation and evaluate the claim’s validity. Understanding the claim process, including deductible payments and coverage limits, is crucial to effectively navigating this potentially complex situation.